Content

Historical cost includes purchase cost plus direct expenditure related to PPE till the prop is put to use. The carrying cost includes the initial valuation plus any additions or capital expenditures less any sales and the accumulated depreciation. Within the PP&E section, items are customarily listed according to expected life. Property, Plant, And Equipment Pp&e Definition For some businesses, the amount of Property, Plant, & Equipment can be substantial. This is the case for firms that have large investments in manufacturing operations or significant real estate holdings. Other service or intellectual-based businesses may actually have very little to show within this balance sheet category.

- Potential investors and analysts look at a company’s PP&E to determine the kinds of capital expenditures it’s making and how it raises funding for its projects.

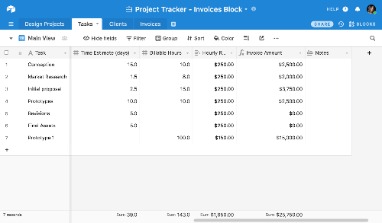

- The easiest way to keep track of fixed capital assets is with a schedule, such as the one shown below.

- It’s important to note that a tangible asset is depreciated for accounting purposes.

Long-term investments, such as bonds and notes, are also considered noncurrent assets because a company usually holds these assets on its balance sheet for more than one fiscal year. PP&E refers to specific fixed, tangible assets, whereas noncurrent assets are all of the long-term assets of a company. The amount of net assets to be reclassified each period is based on the length of the donor-imposed restriction. If, however, as illustrated in Example NP 10-1, the depreciable life of the asset and the donor-imposed time restrictions differ, depreciation and the lapsing of the restrictions will not directly coincide. The historical cost is reported on the balance sheet, and it is depreciated over the asset’s estimated useful life so that an annual charge is included in the entity’s operating cost. Since PP&E is a long-term asset, the purchase of these fixed assets – i.e. capital expenditures – is not expensed immediately during the period incurred.

Educational material on applying IFRSs to climate-related matters

As described and discussed more fully in PPE 3, depreciation accounting allocates an asset’s cost in a systematic and rational manner over the periods during which the NFP benefits from its use. Paragraph IAS 16.8 explains that items such as spare parts, stand-by equipment and servicing equipment are recognised as PP&E when they meet the definition of PP&E. Specifically, an item of PP&E must be expected to be used for more than one period (i.e. one year, though this is not stated explicitly). There are several benefits to disposing of PP&E, these include the improved financial position, reduction in costs and liabilities, improved efficiency or productivity, and better use of resources.

Deferred maintenance is maintenance that was not performed when it should have been performed or was scheduled to be performed and, as a result, is delayed until a future period. FASAB believes that deferred maintenance is a cost but that it cannot be measured well enough to be recognized in the basic financial statements. However, estimates https://quick-bookkeeping.net/ must be disclosed in a footnote based on either condition assessment surveys or comparisons between actual maintenance and life-cycle forecasts. They are given prominence by a line item on the statement of net cost with a note reference in lieu of a dollar amount. This standard applies to both general PP&E and stewardship PP&E.

Recoverability of the carrying amount

Their office buildings and land are PP&E, but the houses or land they sell are inventory. The value of PP&E between companies varies substantially according to the nature of its business. For example, a construction company will generally have a significantly higher property, plant, and equipment balance than an accounting firm does.